Are Gift Cards Taxable to Employees?

Are gift cards taxable? If your business purchases gift cards for employees, make sure you’re not missing this important reporting step.

Employee Benefits Advisory: Gift cards and other employee incentives are counted as taxable income - MUS Law

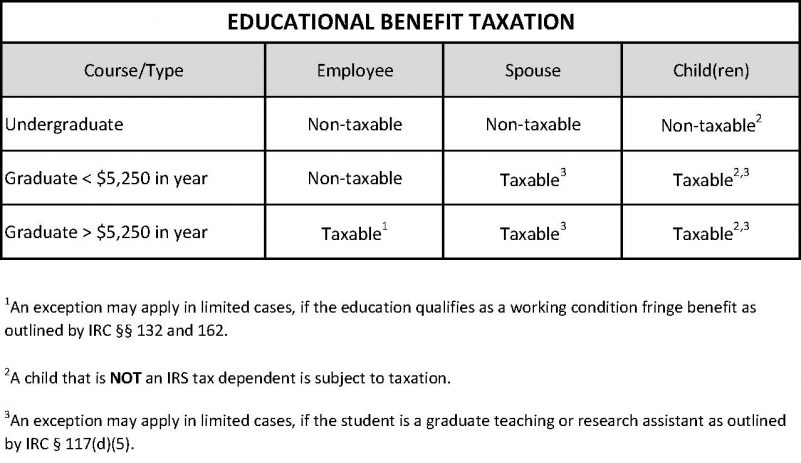

Fringe Benefit Taxation – Tax Office

Gift cards: Small-size gift, big holiday impact, amigos gift card

CRA may tax company gifts to employees: How to know if it's tax

Employee Gifts: What You Need to Know From a Tax Perspective

Are there any tax issues we need to be aware of when we give

Brazil: Mandatory Benefits, Payroll & Taxes Info

Verdict's gift guides: Great Christmas gift ideas to help you

Brazil: Mandatory Benefits, Payroll & Taxes Info

FAQ: Are Gift Cards for Employees a Tax Deduction?

What Counts as Taxable and Non-Taxable Income for 2023

Tax Implications of Giving Gifts to Employees l Small Business Guide for Employee Gift l SwagMagic

Are gift cards taxable employee benefits?

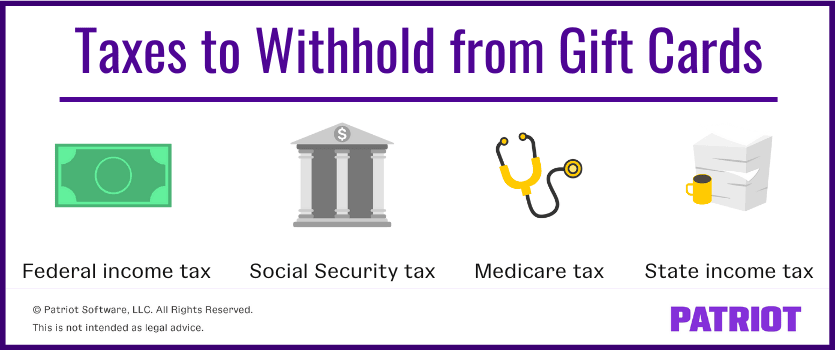

Are Gift Cards Taxable? Taxation, Examples, & More

The Tax Implications of Employee Gifts: An Easy Guide for U.S. Employers