Canadians Believe Canada Revenue Agency Goes Too Easy on Wealthy Tax Dodgers, Internal CRA Report Says

Experts say CRA needs more auditors and resources to crack down on ‘complex’ tax schemes run by corporations and wealthy tax dodgers

The Relationship Between Tax Avoidance And Corporate

Committee Report No. 1 - FINA (43-2) - House of Commons of Canada

RCMP asked to investigate Inuk status enrolment of Kingston, Ont. sisters : r/ontario

CRA audits of ultra-wealthy Canadians have resulted in zero prosecutions, convictions : r/canada

CRA Meeting Nov 2017 - Sutton Office

The Relationship Between Tax Avoidance And Corporate

Are Canadians receiving value for their tax dollars? - Quora

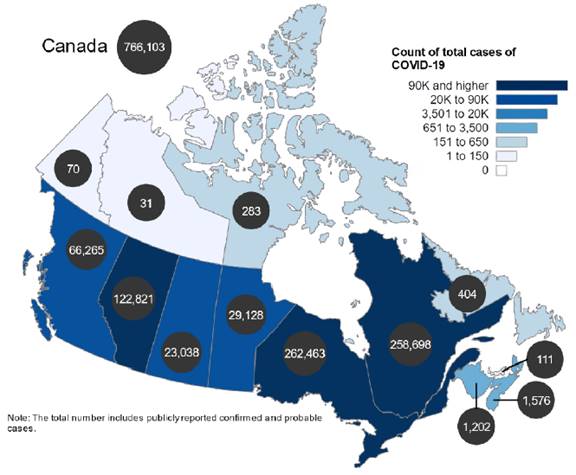

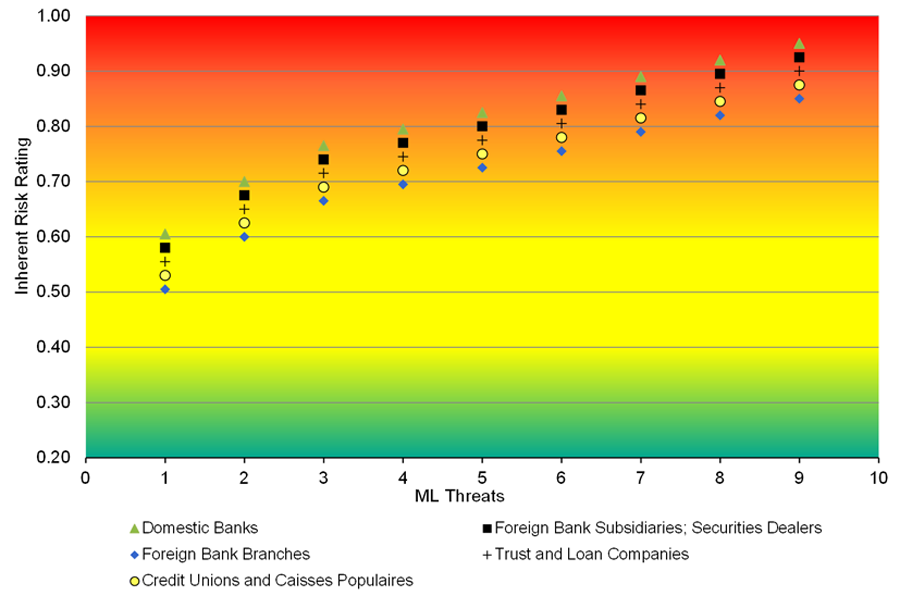

Assessment of Inherent Risks of Money Laundering and Terrorist Financing in Canada

The $100,000 a year waitress isn't a myth: Some hard truths about tipping in Canada

Why should we respect the CRA, if it shrugs at billions overpaid?

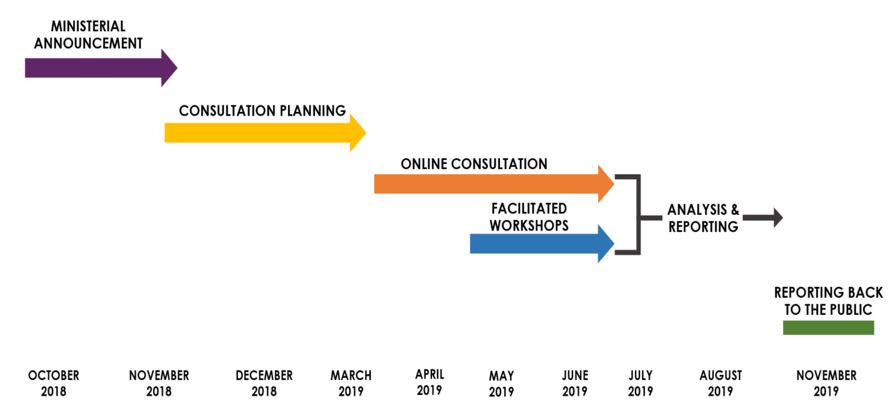

Serving Canadians Better – Consultation Summary Report

The contact by mehramedia mehra - Issuu

The American in Canada, Revised: Real-Life Tax and Financial Insights into Moving to and Living in Canada -- Updated and Revised Second Edition by Brian D. Wruk, eBook

Tax wars, follow-up investigations and who was actually in the Paradise Papers? - ICIJ

Worthwhile Canadian Initiative: The impact of tax cuts on government revenues