:max_bytes(150000):strip_icc()/StraightLineBasis-27e5ac7651b24572a05ef272c2475554.jpg)

Straight Line Basis Calculation Explained, With Example

4.5

(710)

Write Review

More

$ 27.99

In stock

Description

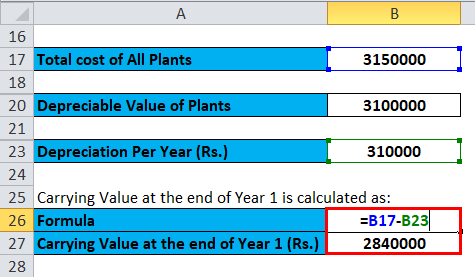

Straight line basis is the simplest method of calculating depreciation and amortization, the process of expensing an asset over a specific period.

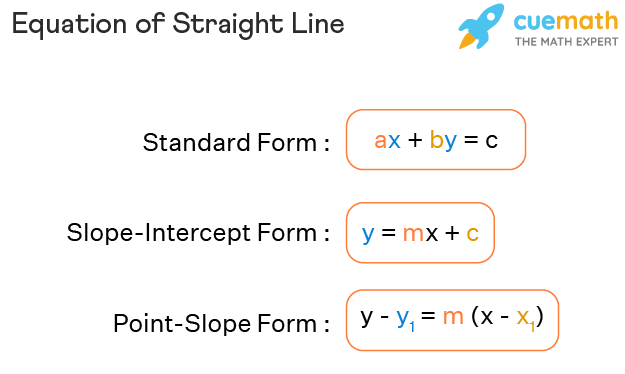

Equation of Straight Line - Formula, Forms, Examples

TI BAII Advanced Functions: CFA Exam Calculator - Kaplan Schweser

Straight Line Depreciation Formula

:max_bytes(150000):strip_icc()/StraightLineBasis-27e5ac7651b24572a05ef272c2475554.jpg)

Straight Line Basis Calculation Explained, With Example

Depreciation Expense Double Entry Bookkeeping

Methods Depreciation Guru

PDF) Capital Allocation Analysis for Utility-like Businesses

Straight Line Depreciation Method

Depreciation Calculator

:max_bytes(150000):strip_icc()/GettyImages-182148191-5661c3cc3df78cedb0b7b349.jpg)

The Best Method of Calculating Depreciation for Tax Reporting Purposes

:max_bytes(150000):strip_icc()/Amazon4-8ae1cf9e4d2e49f08002f3eacc6f081b.JPG)

Amortization vs. Depreciation: What's the Difference?

Line of best fit: Straight Line Basis and the Quest for Optimal Fit - FasterCapital

You may also like

:max_bytes(150000):strip_icc()/GettyImages-671056994-fbd4d68eda99417cbbbc2a8c67a86b03.jpg)