Office Supplies: Are They an Asset or an Expense?

Jun 7, 2023 - Office supplies fall in the asset category, but they are purchased for consumption, meaning it can fall into an expense category. Here's how to classify them.

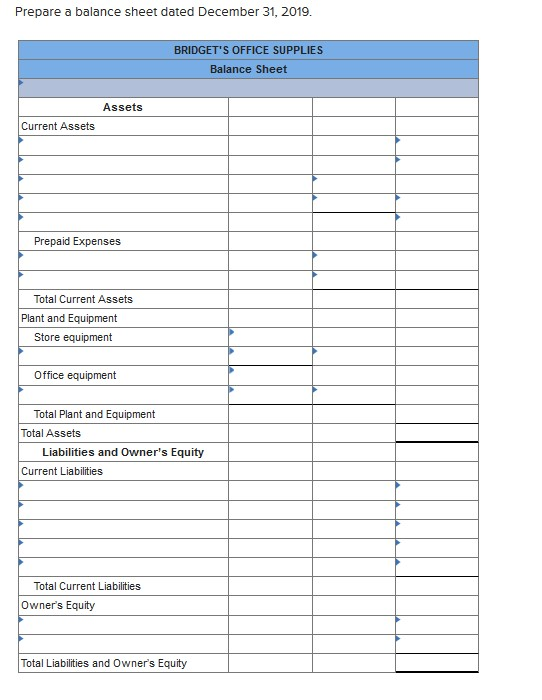

Solved The worksheet of Bridget's Office Supplies contains

Examples of Assets and Expenses

Capital Asset Costs Are Not Deductible As Business Expenses

School Case Safta Pop It Multicolour Set (12 Pieces)

Accounting Basics - Assets, Liabilities, Equity, Revenue, and

Office supply vector stationery School stationery, Writing tools, Stationery

Buy cartridges and Ink bottles Correction pens, Packing tape, Stationery

Are Supplies an Asset? Understand with Examples - Akounto

What is Office Supplies Expense? – SuperfastCPA CPA Review

Is Office Equipment an Asset Or Expense? Office Supplies - Wooden

What Are Operating Expenses? Basics and Examples

Hot Item] PU Desk Pen Holder Office Stationery Desktop Organizer

Wala Cap Press - So many ways to use it!

Is Office Equipment an Asset Or Expense? Office Supplies - Wooden